In recent years, a lot of the Chinese have amassed a fortune from investing in real estate in China.

However, in light of the fear of an imminent bubble, most cities have implemented measures to keep prices down, including eligibility restrictions, increases in required down payments and limits on reselling, for example, no resale of a property within three years of purchase.

In the second-tier cities, the measures have also included price caps on the new property, with local authorities refusing to grant developers sale permits if they deem the prices set for the homes to be too high.

With so much capital controls, what’s next for the Chinese investors?

Individual investors who have been “limited” in China have brought their love of real estate abroad.

The Chinese investors looking for exponential growth would have their sights set on the real estate markets in South-East Asia. Especially Thailand, Malaysia, Cambodia, and Vietnam.

Out of the above mentioned, Thailand would probably be the foremost considered investment destination. Low prices, convenient transportation, beautiful environment, friendship with China, makes Thailand the preferred holiday destination. Thailand also attracts a large influx of foreign population each year.

At the same time, Thailand, as the second largest economy in Southeast Asia and the heart of ASEAN, has a relatively stable political environment and healthy economic exchanges with China.

At present, Thailand has a population of 64 million. Thailand’s foreign exchange reserves rank 13th in the world, reaching 183 billion U.S. dollars, surpassing the economic powers of the United Kingdom, France, and the United States. Thailand has obvious advantages in foreign exchange reserves and can better maintain the stability of the Thai baht.

Thailand is still a developing nation, undergoing a rapid urbanization that was experienced in China during recent years.

In the past two years, China’s investment in Thai real estate has reached an unprecedented high.

Capital Control

China’s capital outflow control has reduced China’s total overseas investment in housing from its high in 2016 to the level in 2015.

Such restrictions have also redirected the capital flow. Markets such as Thailand which is relatively less expensive has attracted a lot of Chinese investors.

This stem mainly from the fact that to invest in Thailand real estate, there is no need for a huge capital outlay. Thus effectively mitigating investment risks as well as creating a low barrier to entry for many.

Of course, it would be good to note that for prime luxury in downtown Bangkok, prices have already passed the THB350,000 per square meter mark, equivalent to approximately 70,000 yuan per square meter.

More importantly for investors, the Thailand housing market is robust and have seen a gradual increase over the years plus being able to give rental returns averaging 5-8% per annum. Such conditions make it favorable and attractive for the Chinese investors.

Benefitting From China’s One Belt One Road Initiative

The Chinese government supports investment in countries that participate in the “Belt and Road Initiative.” These investments are in line with China’s strategy of increasing the number of new infrastructures in China’s neighboring countries and encouraging cross-border trade activities in the region. China’s leading position in the regional economy.

Thailand, with its superior geographical location, has obtained many benefits from regional trade growth, cross-border investment and economic cooperation.

It is worth mentioning about the pan-Asian high-speed rail hub.

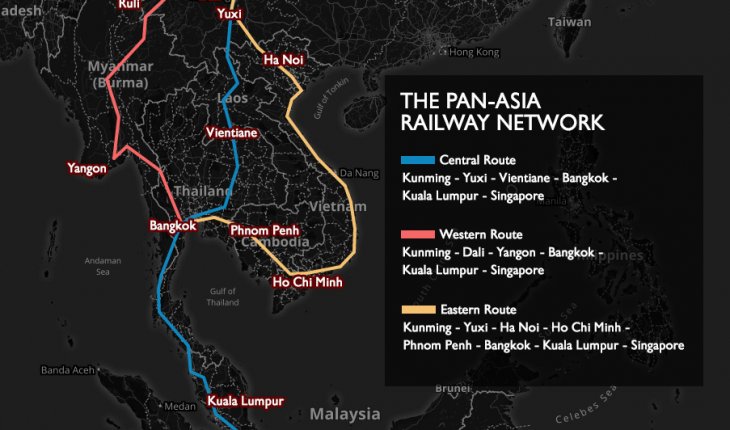

The Trans-Asian Railway is one of the key elements of the economic corridor. Three of the high-speed rail lines will converge in Bangkok.

Geographically, Thailand happens to be at the center of this railway network and will take on the North-South railway line. Other countries connect through the East-West line.

It should be noted that the purchase of commercial and residential real estate is almost the cornerstone of every large project, whether it is a new city, a new manufacturing center or a railway facility.

The Number Of Chinese Travelling Overseas Is Set To Grow Further

Thailand’s proximity to China, its well-developed tourism infrastructure, reasonable housing prices and acceptable culture have attracted these first-time investors to make their first investment here.

At present, only 9% of Chinese citizens hold passports. This figure will double in 2020 to 240 million people.

Such a low passport holding rate means that many Chinese who have the ability to invest in the international real estate have not yet got into the action yet.

It is not difficult to predict that the number of overseas buyers from overseas will still increase in the next five years.

We expect this group of emerging cross-border investors to flock to markets that are both familiar and relatively low-priced to find investment opportunities. Thailand will undoubtedly be one of the easiest to meet these standards.

The Conditions For Owning Real Estate In Thailand Is Simply Attractive.

Freehold property, no estate tax, no need to pay for the public area, fully renovated apartments and no limits to purchase, not limited to loans, can flip properties, stable economic growth, low taxes and fees.

In Thailand, the Chinese investors get to own freehold properties.

Compared to countries like Singapore, the taxes are not punitive at all.

eg.

Thailand: Deed 2% (50% each for buyers and sellers)

Canada: Transaction Stamp Tax 15%

Singapore: Foreigners need to pay 3% stamp duty and an additional 15% stamp duty on overseas investors for home purchases.

In Thailand, investing in real estate is not just about buying a physical property, but it’s also buying a lifestyle.

Nowadays, Thai developers spare no effort to equipped the property with the best possible facilities. (swimming pool, gym, sauna, tennis court, sky lounge, co-kitchen, etc) It is something that has come to be expected when buying a property in Thailand.

Barring any unexpected economic or regulatory change in the investment environment, the demand for Thai real estate by individual investors in China will be expected to continue to grow.